louisiana estate tax rate

Recent changes to the tax rate are reflected as follows. Counties and cities can charge an additional local sales tax of up to 06 for a maximum possible combined sales tax of 56.

Louisiana Income Tax Calculator Smartasset

It later turned around and repealed the tax again retroactively to January 1 2013.

. Such as the current rate of interest charged for borrowing the money to buy or build similar properties. Colorado has 560 special sales tax jurisdictions with local sales taxes in. This mortgage guide is a good place to start to get the basics about getting a mortgage in Louisiana.

There is no. New Jersey phased out its estate tax in 2018. Our Louisiana real estate test prep comes with over 1000 LA real estate test prep practice questions.

Wisconsin has 816 special sales tax jurisdictions with local sales. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

Impose estate taxes and six impose inheritance taxes. How does Louisianas tax code compare. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

Groceries and prescription drugs are exempt from the Wisconsin sales tax. How do I appeal to the Louisiana Tax Commission. Louisiana Citizens Insurance Tax Credit.

For instance if you did not file a Louisiana income tax return for 2009 you must provide your federal tax return for 2009 no later than February 15 2011 to receive more than a 2 if you qualify Earnings Enhancement for deposits made in 2010. Taxes in Louisiana Louisiana Tax Rates Collections and Burdens. Corporation Income and Franchise Taxes.

The tax is determined using tax tables furnished by the Louisiana Department of Revenue. The tax rate is applied in a graduated scale using the taxpayers filing status and the taxpayers Louisiana taxable income. Groceries and prescription drugs are exempt from the Colorado sales tax.

So if a propertys assessed value for property tax purposes is 100000 and the local mill rate is 35 the property tax would be calculated as. See the list of persons approved to brokerage sell or transfer of motion picture. In the first year the property generated an annual cash flow of 75000 but she sustains a 25000 tax loss that she can apply against the income of a very successful car wash that she owns.

North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. A mill is equal to 1 for every 1000 of assessed property value. Louisiana has a graduated individual income tax with rates ranging from 185 percent to 425 percent.

Tennessee repealed its estate tax in. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. 100000 assessed value 1000 100 x 35 3500 property tax or - Mill rate amounts vary from place to place.

Registry of Motion Picture Tax Credit Brokers. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

One reason Louisiana has such low property taxes is the states generous homestead exemption which reduces the taxable value of owner-occupied properties by 7500 in assessed value. Meanwhile the average effective property tax rate is one of the lowest. School Readiness Tax Credits.

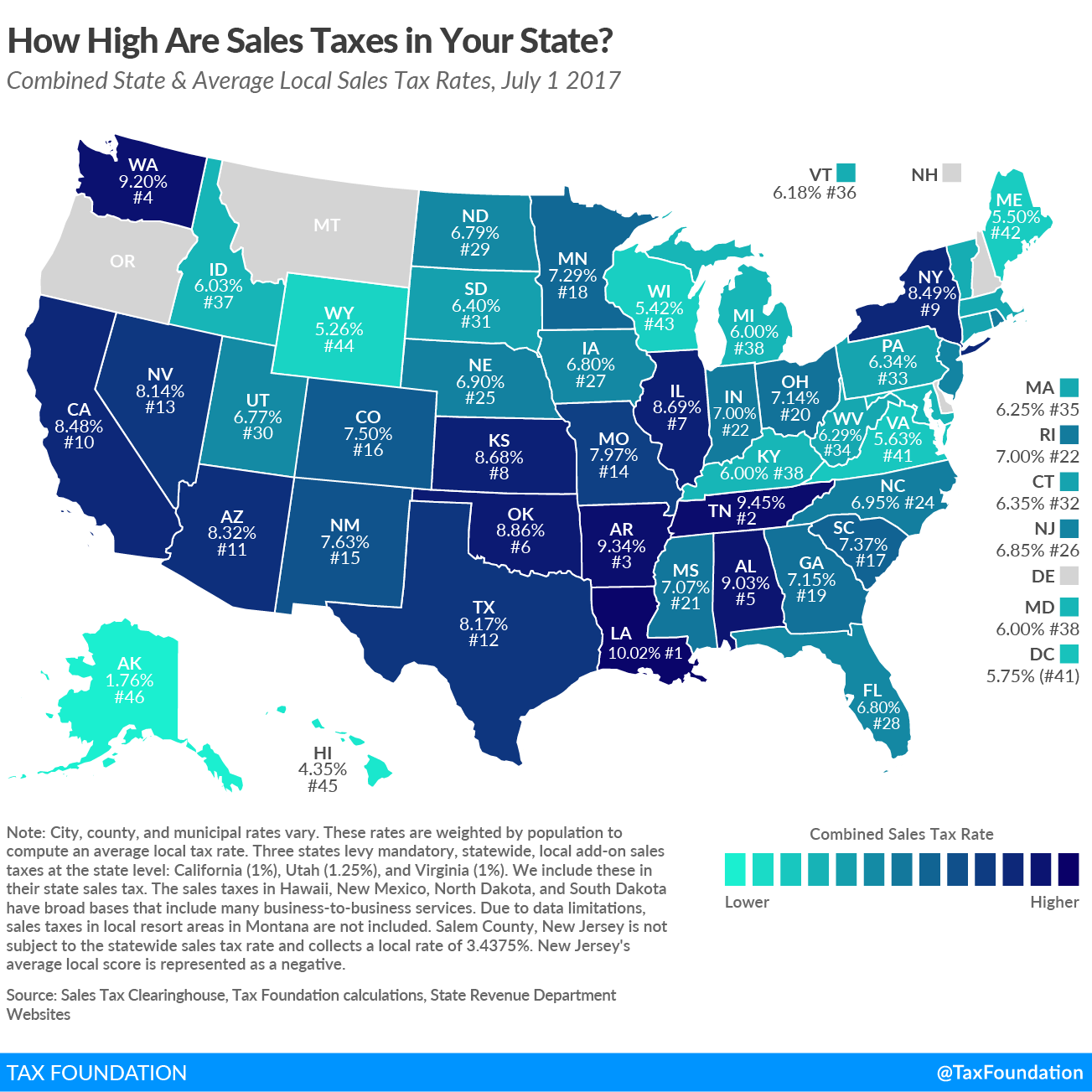

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. Twelve states and Washington DC. Includes all things other than real estate which have any pecuniary value.

Maryland is the only state to impose both. In order to appeal to the Louisiana Tax Commission a taxpayer must start at the parish assessors office. Louisiana also has a corporate income tax that ranges from 350 percent to 750 percentLouisiana has a 445 percent state sales tax rate a max local sales.

The average sales tax rate including local and state in the Bayou State is one of the highest in the country at about 955.

Historical Louisiana Tax Policy Information Ballotpedia

Louisiana S Tax Reform Breakthrough Wsj

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Four Dead 20 000 Rescued From Louisiana Flooding Louisiana Flooding Louisiana Flood

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa West Virginia

Louisiana Retirement Tax Friendliness Smartasset

10 Best States To Form An Llc Infographic

/dotdash-3-of-the-most-lucrative-land-deals-in-history-Final-06e5fc55a7d4426b887548f6e5262989.jpg)

3 Of The Biggest Land Deals In History

Louisiana S Tax Reform Breakthrough Wsj

115 Fitzwilliam Street Louisiana Homes House Styles Tuscany Villa

Louisiana La Tax Rate H R Block

Louisiana Sales Tax Small Business Guide Truic

5 Refreshing Ways To Spend Your Tax Refund

America S 15 States With Lowest Property Tax Rates

122 Poverty Pointe Open Concept Home Louisiana Homes New Homes

State Corporate Income Tax Rates And Brackets Tax Foundation

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Retirement